China's Future: Yangtze River Development

Nowhere is the pressure of increased trade between China and the rest of the world more felt than within the China port structure. In 2002, 10 of the top 50 ports worldwide, were located in China. Without exception, each of these ports posted double digit growth. In 2003, the Port of Shanghai surpassed Busan to become the world’s third largest port with a throughput of 11.28 million TEU. This is up from 8.61 million TEU in 2002 and is not atypical of the growth of most China ports. This growth is expected to be more pronounced along the Yangtze River where more than 8 new terminals are under construction which are designed to handle both breakbulk and container vessels. As recent as 2000, there were no container handling facilities along the Yangtze River. There are two major points of focus driving port development in China:

- Government Policy providing beneficial treatment and priorities for foreign investment in manufacturing, infrastructure and logistics facilities.

- The restructuring and merging of State Enterprises and Port Entities to become more market driven and more efficient.

This paper is a condensed version of a white paper in process, which will analyze the changes taking place in manufacturing and logistics along the Yangtze River. The information gathered for this analysis and documented in various forms, will be turned into a logistics guide for companies seeking to relocate in cities west of Shanghai along the Yangtze River. In October of 2003, a team of three people from Jon Monroe Consulting (JMC) took a trip down the Yangtze River using various modes of transportation, to begin this documentation process. The idea has been germinating for some years however, the completion of the Three Gorges Dam made the timing perfect to make this trip. The activity documented includes the location of manufacturing industries, port facilities, and infrastructure; to include barge, road, rail and air services.

Another factor in the decision to make this trip was the working relationship JMC has with Shanghai International Port Group (SIPG), the newly restructured Shanghai Port Authority. While working on projects with SIPG, they became aware of our interest in the Yangtze River Project and supported us in ways that we never imagined. We were pleasantly surprised to find that SIPG had representatives along the Yangtze River supporting approximately 10 joint ventures with cities up to Chongqing. Our trip down the Yangtze River took 10 days and covered 9 cities. We were supported by SIPG and their team of representatives who assisted us in making the appropriate appointments with Port authorities and local government officials. We are very thankful to Mr. Chen XuYuan, Vice President of SIPG, responsible for Investment and Development, and to Mr. Chen Lishen, Vice President of SIPG, responsible for operations and the staff stationed along the Yangtze River.

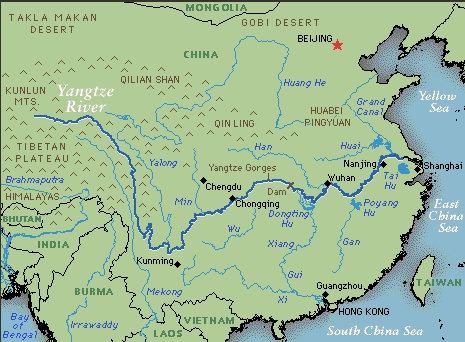

Figure 1: Map of China with Yangtze River

Yangtze River Trip

Many people have asked us what made us decide to make such a trip. Even authorities and businessmen we met along the Yangtze River asked us this question. The answer is simple. We recognized three important developments that are converging to influence a major restructuring of China’s transportation infrastructure.

- The rising costs in manufacturing in South China Cities which will drive manufacturing north to Shanghai and the surrounding area.

- The China government’s new “Go West” policy which is intended to encourage development in the western areas of China. This is a necessary step if China is to balance the economy. Most of the development thus far, has been in the southern and coastal provinces.

- The completion of the Three Gorges Dam. The completion of this project will over time, raise the water levels which is needed to make the Yangtze River navigable to larger vessels as far west as Chongqing.

This trip covered 2400 kilometers from Chongqing to Shanghai. Two legs were covered by a hydrofoil boat and the remaining eight legs were covered by car, over the road. Traveling in this manner gave us the opportunity to assess both the road and river conditions along the Yangtze River.

Yangtze River Development

When we assess the opportunities along the Yangtze River west of Shanghai, we divide the area into three segments. The first and most economically viable segment is the Yangtze River Delta. The definition of this area is sometimes in debate and for our purposes covers the distance from Shanghai to Nanjing including the city and port of Ningbo. The second and interestingly enough, second most economically viable segment is the central Yangtze River. This area we define as covering the distance from Yueyang through Wuhan to Wuhu, a city west of Nanjing. The third segment is the upper reach of the Yangtze River.

Figure 2: Map of Yangtze River

The third segment of the Yangtze River is what we termed ‘The Upper Yangtze”. This section includes the cities from Chongqing to Yichang. Yichang is located in the Three Gorges reservoir. This area is the least developed and is in the process of undergoing a major transformation. Most cities are located on hills as the Upper Yangtze is set in a valley and most of the time is covered in fog.

Upper Yangtze River

When one looks at a map of China, it may be asked why Chongqing and cities to Yichang should be considered the Upper Yangtze River. Geographically, Chongqing is located in the lower Yangtze River. Chongqing is the furthermost point west of Shanghai that can handle cargo vessels with a supporting infrastructure that allows companies to distribute their goods to other cities in China. Though there are a few small cities further West along the Yangtze River, Chongqing is considered the gateway for Southwest China and for the most part, the area further west along the Yangtze is not navigable by vessel. The Upper Yangtze River can be defined as the upper reaches of the lower Yangtze River which covers the area from Chongqing to Yichang to include Chendu and cities of the Sichuan Province.

The potential of the upper Yangtze River is far from being understood or realized. One little known fact that seems to be lost on the rest of the world is that Chongqing is technically the world’s largest city with a population of 31 million people. Made a municipality in 1997, Chongqing is now one of four municipalities to include Beijing, Tianjin and Shanghai. This should underscore the importance the China government places on Chongqing and the development of Western China. Just as important, is the location, strategically situated as a gateway to Southwest China. The population along the Upper Yangtze River which includes the Province of Sichuan and Municipality of Chingqing is approximately 115 million people. With the completion of the Three Gorges Dam in June of 2003, a renaissance has begun that will transform the upper Yangtze River into a productive manufacturing and agricultural mecca.

Both the local and central governments are aggressively pursuing an investment and development strategy to connect this region with the key international gateways in China. Investments in new roads, railways, airports and port facilities are currently under construction to support the migration of manufacturing and logistics development to this Southwest China. For example; in 2000, there were no container facilities to handle the movement of containers in and out of Chonqing and the ports along the Upper Yangtze River. Most barges handled primarily breakbulk. In 2003, Chongqing port will have a throughput of approximately 95,000TEU. What is more amazing, is that the current plan supports the expansion of the current terminal to handle more containers and the construction of a new terminal that together will have a design capacity of 700,000TEU throughput by 2009.

Figure 3: Chongqing Port

Figure 3 provides an example of the many challenges faced by the port authorities along the upper reaches of the Yangtze River. The cities are located along the river in a mountainous area with water levels that rise and fall as much as 30 meters. Figure 3 shows a floating crane that must transfer the container to a tram system which moves the container up the hill to the terminal where it is picked up by a gantry crane and dropped on a truck to move it to the appropriate stacking location. Three new terminals are being built along the upper reaches that will more than triple throughput in the coming three years. The barge transit to Shanghai is 7 to 10 days depending upon the service however, at least one new barge company will be offering a Chongqing to Shanghai express service with a 7 day transit.

Central Yangtze River

The central Yangtze River includes cities from Yueyang through Wuhan to Wuhu and winds through the Provinces of Hubei, Hunan and Anhui. Wuhan may be the most important cityin the Central Yangtze Region. Wuhan is strategically located, central to both the east-west flows of the Yangtze River connecting

Chongqing to Shanghai and the north south rail line connecting Beijing in the north with Guangzhou in the south. Wuhan might very well become the Chicago of China. Historically, Wuhan has been considered the gateway to nine provinces. Companies like Anheuser Busch have located here and handle their distribution throughout China from a single location. Using the Yangtze River for east-west traffic and and the rail lines for north-south traffic, Anheuser Busch can distribute product to most major cities in China. A little known fact in the U.S., is that Anheuser Busch now has 50% of the premium beer market in China. They have accomplished this using a single location to distribute product to their distributors.

The central Yangtze River region is noticeably more active than the upper reaches. This is in part, due to fact that larger vessels can call Wuhan vs. Chongqing, Wanzhou and Yichang. Wuhan can handle up to 5,000 ton vessels. As we moved down river from the upper Yangtze, we could sense the increased activity. There is also a more diverse manufacturing base in the central region. Sophisticated special economic zones are either being constructed or in the final stages of completion. Both Jiujiang and Wuhu have sophisticated plans for the development of side by side manufacturing and logistics facilities.

Figure 4: Wuhu Economic Development Area

Figure 4 shows the model of the new Wuhu Economic Development Area being built to encourage investment in manufacturing and logistics.

Yangtze River Delta

The Yangtze River Delta (YRD) covers the area from Shanghai to Nanjing and includes the provinces of Zhejiang to the South and Jiangsu to the North. The key cities of the Yangtze River Delta include Shanghai, Nanjing, Ningbo and Hangzhou. The YRD accounted for 23.5% of China’s industrial production and 17.2% of the country’s GDP in 2002. This was accomplished by only 6.2% of China’s population using only 1% of the nation’s land. The Yangtze River Delta area is where most of the manufacturing base supporting U.S. retailers have set up operations. Cities like Suzhou, Wuxi, and Hangzhou have overnight been transformed from farmlands to manufacturing centers.

It has only been since the 90’s that Shanghai began pursuing a more aggressive stance to support the development of the city as a trade center with the creation and opening of the special economic zone in Pudong. In 1996, Shanghai’s role was expanded with the creation of the Shanghai Combined Port Authority (SCPA) which was established as a cross regional authority to coordinate port development activities in Shanghai and the ports located in the provinces of Jiansu and Zhejiang. This is what is now often referred to as the Yangtze River Delta.

Figure 5: Yangtze River Delta

It is only a matter of time before the Yangtze River becomes a manufacturing basin that in our estimation, has the potential to surpass the Pearl River Delta. Admittedly, this is a point of argument that is currently under debate. Many in Hong Kong argue that Shanghai and the Yangtze River Delta cannot hope to compete or keep up with developments in Guangdong province and the Pearl River Delta area. Many projects that are currently under development in South China are cited by the Hong Kong government as proof that there is still life and growth in the Pearl River Delta. In fact, the Hong Kong government has an analysis posted on their investment website at www.investhk.com.hk that attempts to make this point. Our purpose is not to make the argument that one manufacturing area is better than another but to analyze the potential of new areas and document the transportation and logistics infrastructure available to support this migration of manufacturing and logistics companies to Central and West China. When we think of it this way, we cover not simply the Yangtze River Delta, but the area from Shanghai to Chongqing including the Yangtze River Delta. Depending on how one counts the population in this area, it includes between 360 million and 410 million people.

The Role of Shanghai as the Head (Gateway) of the Dragon

Shanghai is often described as the head of the dragon. The dragon referred to of course, is the Yangtze River. This is another way of making the point that Shanghai is the gateway to central and southwest China and all it has to offer. Depending upon how they are counted, there are somewhere between 360 million and 410 million between Shanghai and the Chongqing-Chengdu corridor. This includes the Yangtze River Delta area and the provinces that lie along the path of the Yangtze River to Chongqing. The cities of these provinces feed into the Yangtze River and in a very real sense, create a unique economic unit.

There is little doubt that Shanghai has become the driver for future development of the Yangtze River Delta area. Shanghai may become even more key to the successful development of the entire Yangtze area once the deepwater port is completed. Three factors will continue to drive Shanghai’s growth as a trade gateway through the next decade.

-

The completion of the deepwater port which will attract the larger 8,000+TEU vessels.

-

Development along the Yangtze which by 2006, will increase dramatically the throughput from the Yangtze River making Shanghai a key river gateway port similar to Rotterdam.

-

Transition to a major transshipment center for the countries in Northeast Asia

Conclusion

China’s development will create new opportunities for Foreign Direct Investment as manufacturing and distribution facilities move north to Central, Western and Northern China. Since 1979 the development of manufacturing and logistics has been largely concentrated on South China and the Pearl River Delta. Now, at the dawn of the new century, we are witnessing the emergence of Shanghai as a major gateway to and from China as the central government allocates more investment dollars for infrastructure investment in Western China. In the governments 10th Five Year Plan (2001 to 2005) approximately US $85 billion has been allocated for investment in the Western Provinces and this is a keystone of China’s “Go West” Policy.

Shanghai will be a key driver as the gateway to one of the most economically vibrant regions in the world. Consider the following:

|

In 2003, Shanghai surpassed Busan to become the world’s 3rd largest port registering 11.28 million TEU |

|

The new Yangshan deepwater port is expected to increase Shanghai’s throughput to 25.4 million TEU by 2020 |

|

There are 8 to 10 new terminals being built along the Yangtze River that can handle containers and will become operative by the end of 2005 |

|

With the new deepwater port operative, Shanghai has the potential to become a major transshipment port |

|

Approximately 364 million people live between Chengdu-Chongqing and Shanghai, depending upon how the provinces are counted; arguably the world’s largest and most competitive labor market |

|

Since January of 2003, the China government and cities along the Yangtze River, have held annual conferences to study integration of the cities along the Yangtze River into a single economic region |

|

As manufacturing and transportation costs rise in South China, the Yangtze River area, becomes a more viable manufacturing center to keep costs down |

|

The Yangtze River cities are learning quickly from their southern neighbors |

With the entry of China into the WTO, the role of Shanghai as a gateway takes on a new meaning, as the country moves to address both manufacturing and distribution. U.S. and European companies will benefit during this transition as management talent and technology become necessary to support the evolution of Central and Southwest China into an integrated economic unit. The beneficiaries will include most industries however, the greatest impact in the short term will fall to companies in one of three categories:

-

Automotive Companies and Suppliers: The automotive industry in China has exploded as the up and coming younger middle class will continue to pursue a dream to own an automobile. The automobile market exploded in 2003 as China surpassed Germany to become the world’s third largest auto market. Improved infrastructure will provide easier access to cities and lower cost distribution to dealers. RO/RO facilities and over the road car carrier services will improve considerably.

-

Retailers will move more of their sourcing to the Yangtze River Delta and beyond. Textiles and low value plastic products will be the first to move. These will be followed by other consumer merchandise as price continues to become an issue for the consumers of the U.S. and Europe. Retail buyers are already spending more time in Shanghai and buying offices are beginning to emerge in the city.

-

Consumer goods companies that have China as a market will also benefit from these changes. Rapid improvements in the river, road, rail and domestic air transportation network will lower the cost for these companies to reach the China consumer market. Companies will begin moving inland as the infrastructure improves and cities like Chongqing, Wuhan, Jiujiang and Wuhu are cities that come to mind which will benefit from these changes.

In spite of the growing controversy surrounding the competition between the Pearl River Delta area and the cities along the Yangtze River, it is becoming clear that manufacturing and logistics companies will migrate north to this region. As the completion of the Yangshan deep water port becomes a reality, Shanghai will become a key driver in this transition.

Read Yangtze River White Paper

Read Yangtze River White Paper  View JMC China Maps

View JMC China Maps  View 2003 Trip Details

View 2003 Trip Details